31+ Equity loan mortgage calculator

Use our Loan Overpayment Calculator to see how overpaying your loan payment can reduce the total cost of your loan. 045 percent to 105 percent depending on the loan term 15 years vs.

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Fixed rates from 799 APR to 2343 APR APR reflect the 025 autopay discount and a 025 direct deposit discount.

. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. To give you a better idea lets say the conforming limit for a 2-unit house in your area is 702000. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. People typically move homes or refinance about every 5 to 7 years. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

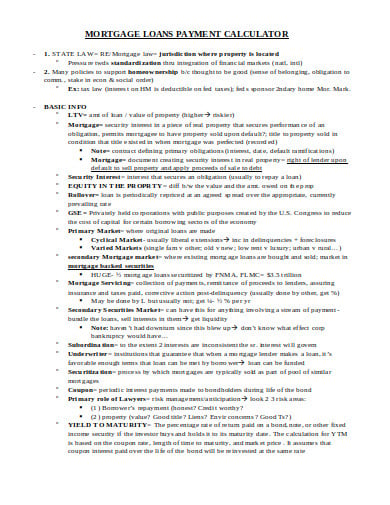

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The mortgage amortization schedule shows how much in principal and interest is paid over time.

Aug 31 2022 1036pm. 31 2022 1000 am. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Todays national mortgage rate trends. With so many ways to tailor your loan to.

You can apply to add on up to your original mortgage amount with minimal costs. Second mortgage types Lump sum. Debt-to-income DTI Mortgage Loan Limits for 2022.

Certain government programs such as SBA loan programs and contracting opportunities are reserved for small businesses. Generally speaking for most borrowers the back-end DTI ratio is typically more important than the front-end DTI ratio. See how those payments break down over your loan term with our amortization calculator.

30 years the loan amount and the initial loan-to-value ratio or LTV. Rates and repayments are indicative only and subject to change. Build home equity much faster.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Loan amounts range from 25000 to 150000 with terms of five to 20 years. Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff.

And when you make extra payments on top of your bi-weekly payments youll increase savings and cut more years from your payment term. SoFi rate ranges are current as of 82222 and are subject to. Furthermore it helps you gain home equity sooner.

Annual mortgage insurance premium. The land mortgage calculator returns the payoff date total payment and total interest payment for your mortgage. A home equity loan can give you a lump sum of cash at a low interest rate but you must use your home as collateral to secure the loan.

In order to qualify businesses must satisfy SBAs definition of a small business concern along with the size standards for small business. Leverage Your Home Equity Today. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. For basic loan options you wont find VA FHA or USDA loans here Ally offers competitive rates and standard lender fees which range from 2 to 5 of the loan. A home equity loan is a good option if you know how much you need to borrow if for example youre consolidating.

Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. Mortgage Calculator How Much House Can I Afford. This allows you to obtain a home equity loan which can fund major expenses such as future home improvements or even your childs college tuition.

However if you exceed the 702000 loan limit your mortgage will classified as a non-conforming conventional loan. Why BMO Harris Bank is the best home equity loan for different loan options. Our rate table lists current home equity offers in your area which you can use to find a local lender or compare against other loan options.

If you took a mortgage at 500000 for a 2-unit home it is considered a conforming loan. Second mortgages come in two main forms home equity loans and home equity lines of credit. The CNET mortgage.

Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc. Example Required Income Levels at Various Home Loan Amounts. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

So that the calculator bases your loan limit on the back-end limit you enter. If you were to borrow the additional 64000 with the add-on option your existing mortgage rate would be blended with the current rate for a 3-year term mortgage and your monthly payments would be adjusted to reflect the new amounts of principal and interest. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. If a person. Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years.

The loan is secured on the borrowers property through a process. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

10 Steps To Purchasing A Home Home Buying Home Buying Process Home Buying Checklist

Idbi Bank Introduces Reverse Mortgage Loan For Senior Citizens It Seeks To Monetize The House As An Asset A Mortgage Loans Refinance Mortgage Reverse Mortgage

Mortgage Refinance Calculator Excel Spreadsheet Refinance Mortgage Mortgage Refinance Calculator Refinance Loans

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Image Result For Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Amortization Calculator Line Of Credit Mortgage Calculator

Tumblr Home Equity Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

What Are The Advantages And Disadvantages Of Payday Loans For People With Bad Credit Payday Loans Bad Credit Payday

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Types Of Mortgage Refinancing Programs Refinance Mortgage Refinancing Mortgage Home Refinance

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Loan Payoff Calculator Paying Off Debt Mls Mortgage Loan Payoff Credit Card Consolidation Credit Card Payoff Plan

Pin On Financial Services

Reverse Mortgage Lenders Reverse Mortgage Loans Mortgage Quotes Reverse Mortgage Refinance Mortgage

Pros And Cons Of 15 Year Mortgages Buying First Home First Home Buyer Home Buying Tips